Crypto taxes: Simplified.

- Effortlessly manage all your crypto transactions for free

- Connect via API and wallet addresses for automatic calculations

- Handle tax filing and manage your portfolio all in one place

Crypto taxes: Simplified.

Top-class coverage

Support for all platforms,including  Exchanges

Exchanges

Compatible with exchanges, blockchains, and DeFi services. cryptact automatically calculates not only crypto exchange trades but also DeFi and NFT transactions.

Features

Easily manage assets and prepare for tax filing, even if you have a large number of transactions.

Full coverage on Free plan

From international exchanges to DeFi and NFTs, cryptact covers it all with the Free Plan. Upload up to 100,000 transactions at no cost—perfect for handling a variety or high volume of trades.

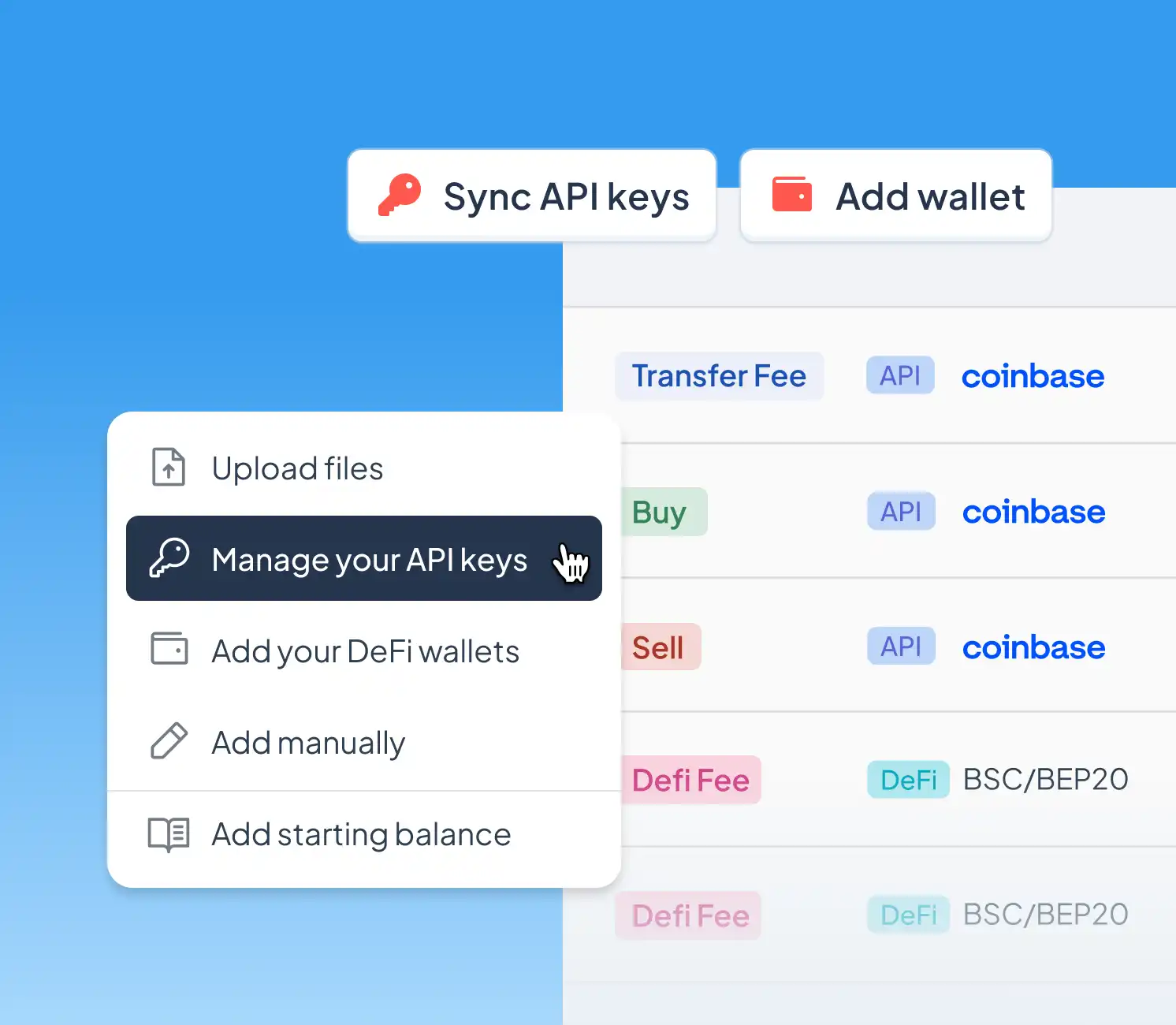

Effortless data sync via API and wallet addresses

Instantly sync transaction data with API integration (supporting over 30+ exchanges) and wallet connections. Our service auto-identifies DeFi and NFTs. P&L calculations are simple for anyone.

See your transaction status at a glance

Manage all your coins with the portfolio feature. Check balances and prices in real-time, and visualize your data for smarter investment decisions.

Full coverage on Free plan

From international exchanges to DeFi and NFTs, cryptact covers it all with the Free Plan. Upload up to 100,000 transactions at no cost—perfect for handling a variety or high volume of trades.

Effortless data sync via API and wallet addresses

Instantly sync transaction data with API integration (supporting over 30+ exchanges) and wallet connections. Our service auto-identifies DeFi and NFTs. P&L calculations are simple for anyone.

See your transaction status at a glance

Manage all your coins with the portfolio feature. Check balances and prices in real-time, and visualize your data for smarter investment decisions.

Supports over 24,701 coins!

We continually add new cryptocurrencies, so you can calculate trades without the

hassle of manual entry, no matter the currency.

Testimonials

Trusted by 150,000+ users

Many users have shared how it helped them organize their trades and reduce the burden of tax filing!

Pricing

Our plans tailored to your needs

Access all transaction types starting with the Free Plan. You can upgrade to a paid plan anytime.

Free

/year

Transactions/year:

Free plan key features:

- Live portfolio view

Average Cost (ACB), FIFO, LIFO + more

200+ fiat pairs, 10+ reporting currencies

- 20,000+ cryptocurrencies

Unlimited exchanges & wallets

DeFi automated classification

NFT transaction support

Custom transactions/custom file support

- Upload file size up to 50 MB

Basic

/year

Transactions/year:

Everything in Free, and:

- Data retention

- Email support

- Ledger download

Prime

RECOMMENDED

/year

Transactions/year:

Everything in Basic, and:

Auto-renewal discount

- Upload file size up to 200 MB

Pro

/year

Need more transactions per year?

Everything in Prime, and:

- Corporate fiscal year-end setting

Conditions apply to the annual transaction limit for Pro Unlimited. Please review them before purchasing. Read conditions Prices shown include tax. Cryptocurrency payments are also accepted. The final amount may vary due to credit card fees or exchange rate fluctuations. * For the Free plan, if you add more than 50 transactions in any given year, the results of your profit and loss calculations will not be displayed.

Please note that payments are non-refundable once confirmed. Additionally, paid plans will automatically renew unless you change your settings after purchase.

Feedback from Tax Professionals

A trusted service highly rated by experts

Many tax accountants and CPAs appreciate cryptact for its accuracy and simplicity in handling

complex crypto profit and loss calculations.

Yuichi Murakami

Certified Public Accountant Office

For those who used to manually gather data from different exchange formats, cryptact greatly reduces the effort required to obtain and reflect transaction histories and market prices.

The service is also highly convenient for those frequently trading DeFi and NFTs, as it allows data import simply by connecting wallet addresses. With automatic identification, it’s a user-friendly tool, especially for those actively trading. By uploading transaction data regularly, users can easily track their assets and plan their strategies for the year-end.

Takuya Tanabe

Cointax

I’ve been using cryptact since its launch, and I’ve noticed continuous improvements in the number of supported exchanges, currencies, and user experience. It’s become even more user-friendly.

It follows tax guidelines, flags unusual transactions, and minimizes errors. I highly recommend it.

Support

Crypto tax filing FAQs

Get answers to common questions about cryptocurrency taxes and how cryptact can simplify your filing process.

Do I need to pay taxes on my cryptocurrencies?

In many countries, yes. For example, in the United States and Australia, cryptocurrencies are taxable. It's important to understand that tax is triggered not only when selling but also when exchanging one cryptocurrency for another. Knowing when gains or losses are recognized is crucial.

Can I avoid paying taxes on crypto trades?

Avoiding crypto taxes is illegal. Tax authorities in various countries have ways to track transaction data, and failure to report can lead to penalties.

How does cryptact help with crypto taxes?

cryptact fetches your transactions from major exchanges and blockchains, finds the market prices at the time of your trades, matches transfers between your wallets, and calculates your crypto capital gains. All you need to do is enter the results on your tax form.

I only made a loss on cryptocurrencies. Do I still have to file taxes?

Yes, in most countries, you are still required to report losses on your tax return, even if you didn't make any gains. Reporting losses can work in your favor, as they can offset gains in future years and potentially reduce your tax burden. Be sure to check the specific requirements for your country.

What happens if you do not pay taxes on cryptocurrencies?

Not reporting your cryptocurrency profits can result in legal consequences. Depending on the extent, it may be considered tax evasion or avoidance, leading to fines, penalties, or even imprisonment in severe cases. You would also be required to pay back taxes along with additional interest or penalties for the delay.

When is crypto tax-free?

The tax treatment of cryptocurrency varies by country. In some places, specific transactions like airdrops or long-term holdings may be exempt from taxes. Many countries also offer a tax-free allowance on income.

Have more questions about crypto taxes and tax filing? Read more on our blog

Filing taxes scary on your own?

We offer a program to connect you with tax professionals who specialize in cryptocurrency.

We offer a program to connect you with tax professionals who specialize in cryptocurrency.

Read our documentation

We've gathered guides on downloading exchange histories, getting APIs, basic usage, and common questions.

We've gathered guides on downloading exchange histories, getting APIs, basic usage, and common questions.

Latest News

Get started with cryptact today!

No credit card required. Get access to a wealth of free features that make it easy to calculate your cryptocurrency capital gains.